Menu

Menu

By Kumar Shailabh

In the wake of upcoming Budget Session of Parliament, the NDA government is gearing up to prepare the Union Budget 2016-17. The Ministry of Finance is holding pre-budget consultations with various groups for their inputs to make the budget inclusive and progressive. The Finance Minister, in his opening remarks during the Pre-Budget Consultation with Social Sector mentioned that “Inclusive growth is high on the priorities of the present government and the government will take adequate measures to ensure social security for the children, women and senior citizens of the country”.

Similar promises were made even last year when the Finance Minister mentioned in his Budget Speech of 2015-16 that the government is committed for the welfare of poor and adequate provisions have been made for the schemes for ‘poor’ and ‘disadvantaged’. But the allocation of financial resources for social security programmes and particularly programmes related to children reflected otherwise.

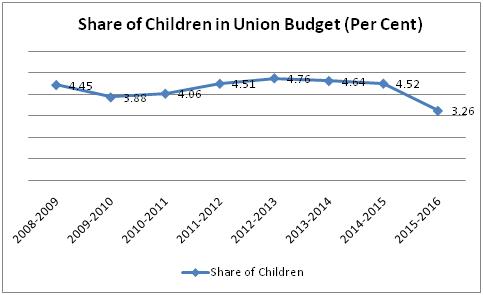

The child rights community was shocked to see sudden and drastic cuts in budgets for children in the national budget, 2015-16. Children received a meager 3.26% share in total financial resources, which is a massive 29% reduction in the share of children from 2014-15 Union Budget. Since the child budget was adopted by the Govt. of India in 2008-09, children received the lowest allocations in last eight years in 2015-16. heme-font: minor-latin;mso-bidi-font-family:Mangal;mso-bidi-theme-font:minor-bidi; mso-ansi-language:EN-US;mso-fareast-language:EN-US;mso-bidi-language:AR-SA'>The Finance Minister, in his opening remarks during the Pre-Budget Consultation with Social Sector mentioned that “Inclusive growth is high on the priorities of the present government and the government will take adequate measures to ensure social security for the children, women and senior citizens of the country”.

What is more, the allocations for Ministry of Women and Child Development were cut down by almost 51 per cent in the 2015-16 Union budget. Similar budget cuts were made for other key ministries as well.

|

Budget Cuts in Key Social Sector Ministries |

|

|

Ministry |

Percentage Fall in Allocation (between 20014-15 and 2015-16) |

|

Ministry of Human Resource Development |

-17% |

|

Ministry of Women and Child Development |

-51% |

|

Ministry of Health and Family Welfare |

-13% |

Not just this, allocations for most of the children specific centrally sponsored schemes (CSS) were cut down severely. For example, allocation for Integrated Child Development Scheme (ICDS) was slashed down by 54%, for Sarva Shiksha Abhiyan (SSA) the allocation was cut down by 21%.

|

Scheme |

Percentage Fall in Allocation (between 20014-15 & 2015-16) |

|

Sarva Shiksha Abhiyaan |

-20.74 |

|

Mid- day meal Scheme |

-30.11 |

|

Rashtriya Madhayamik Shiksha Abhiyaan |

-28.70 |

|

Scheme for Setting up of 6000 model School at Block Level As bench mark of Excellence |

-99.92 |

|

Support to Education including teacher training |

-36.55 |

|

Integrated Child Development Services (ICDS) |

-54.19 |

|

Deendayal Disabled Rehabilitation Scheme |

-33.33 |

|

Manufacture of Sera Vaccine |

-18.03 |

|

NRHM-RCH Flexible Pool |

-21.63 |

|

National Programme for Youth and Development |

-28.75 |

|

Scheme for prevention of Alcoholism and substance(drug) abuse |

-66.81 |

Blame it on Devolution…

The Statement 22 (a separate budget statement on children related scheme) of 2015-16 Union Budget, explained these cuts on account of enhanced devolution of Union Taxes to State as recommended by the Fourteenth Finance Commission (FFC) and to keep the Budget for such programmes unchanged, States are to contribute from their enhanced resources. The Fourteenth Finance Commission recommended that share of the states in the divisible pool of taxes should be increased to 42% from 32%.

Has Devolution Actually Worked or Raised Concerns??

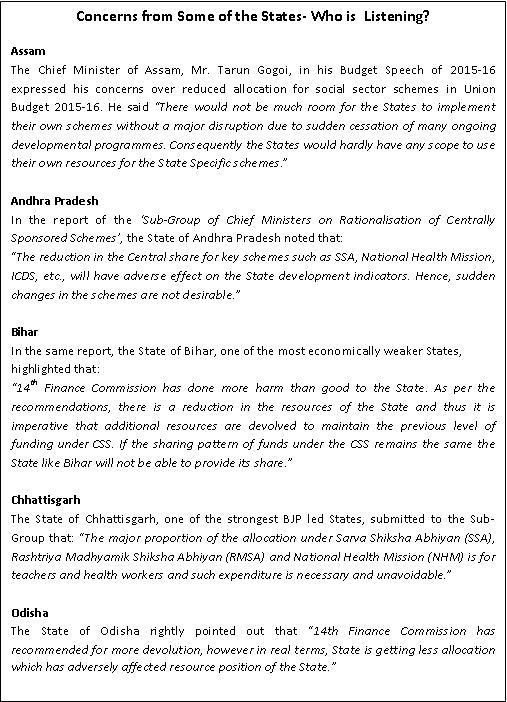

While, in principle, the Devolution of Central taxes to States is an ideal arrangement, there have been various media reporting of States feeling discomfort around the new development. Economists are concerned over the suddenness with which the changed devolution mechanisms been thrust upon States.

According to Dr. Jean Dreze, the devolution of central taxes to States is not bad in principle, but what is objectionable is that it is being done without warning or clarity. Professor Yashvir Tyagi, another economist is of the view that “the Centrally Sponsored Schemes are meant to have national focus on poverty alleviation or welfare. By putting the onus on States, Centre is shedding its responsibility.” Apart from the experts and the activist groups, and the States have been voicing the discomfort around this new fiscal development.

Although, devolution of Central taxes to State governments are expected in increased share of States, but the States’ revenue are not going to increase by multiple folds. For example, Tamil Nadu has not gained due to higher devolution of taxes. There is only 1.16% increase there to Tamil Nadu State after increased devolution by the 14th Finance Commission. Moreover, most of the weaker States are not fully equipped to generate resources on their own and it is feared that children related schemes would not form core of the State agenda. Thus in order to fulfill the National Development Agenda, States cannot be left on their own without significant support from the Central government. The States have raised their inability to adapt to the new fiscal arrangement even in the Sub-Group of Chief Ministers on rationalization of CSS, constituted by NITI Ayog.

Amidst so much of discomfort and confusion voiced by the States, there are serious questions on the intent and efforts of the central government towards ensuring the social security, particularly of children. Certainly, the hurriedness with which the devolution is being introduced and how the support for CSS is being withdrawn by the Central Government, do not show a healthy roadmap for children.

What the Union Budget (for Children) must Address…

in order to ensure the inclusion and social security of children, the Central government must pay attention to the concerns raised by Sates and the upcoming Union Budget must include some of the following policy asks which are pertinent to the issues of children:

1) Centrally Sponsored Schemes related to children must be majorly financed by the Union Budget and States’ role in implementation of these schemes should be seen as supplementary. Thus, as highlighted in the ‘Chief Minister’s Sub-Group Report on Rationalisation of CSS’, children related schemes are one of the critical elements of National Development Agenda and these programmes must be kept in the “Core of the Core Schemes” category and the burden of implementing the CSS should not be left to the States majorly.

2) Allocations of financial resources for the key nodal ministries and flagship schemes related to children must increase significantly in Union Budget 2016-17. At the same time, the programmes related to child education and child health must be adequately financed to meet the challenges. Child ptotection has always been at the peripheries and this must be addressed by investing into the programmes designed to create the protective net and to mainstream children falling out of the protective net.

3) Children related legislations and commitments must have financial backing and be adequately resourced in the upcoming Union Budget

Legislation and policies meant for ensuring protection of child rights must have financial provisions reflected in the budget. For example, Protection of Children from Sexual Offences Act, 2012 (POCSO), does not have any financial backing built in the budget. As a result state governments are struggling to find resources for meeting requirements of special educators, translators and interpreters, setting up special courts with child-friendly infrastructure etc. Thus, such legislation and commitments must be backed with a scheme to find a place in the upcoming budget 2016-17.

4) Timely disbursal, utilisation and a proper monitoring mechanism needed to achieve

outcomes

Under expenditure in flagship schemes affects implementation and thus adequacy of allocations cannot be assessed. Effective measures of monitoring and accountability must be developed to curb under-expenditure. Timely disbursal, utilisation and a proper monitoring mechanism will reduce under-spending.

5) Integrated Child Protection Schemes (ICPS) needs to be strengthened in the light of new Juvenile Justice Act

ICPS is the only scheme for child protection in our country introduced in the Eleventh Plan. With the newly enacted JJ Act, 2014; there are new mandates of bringing on board experts, psychologists, counsellors etc for proper rehabilitation. This additional responsibility would require more funds. Moreover, the new Act also talks about creating “Borstal Homes” or “Place of Safety” for young offenders committing serious crimes. It must be noted that these facilities do not exist in the country. Unless the financial provisions for these establishments are not reflected in the upcoming budget for ICPS, we would fail to achieve the objectives of reform and rehabilitation of children falling out of protective net.